|

|

|

|

|---|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

|

|

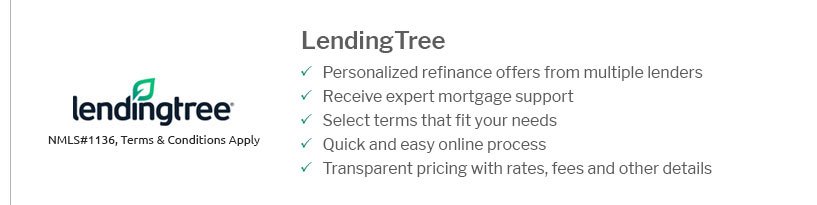

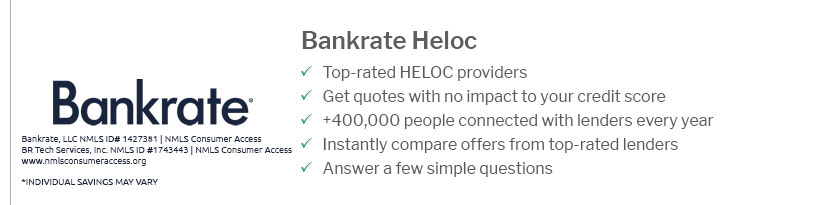

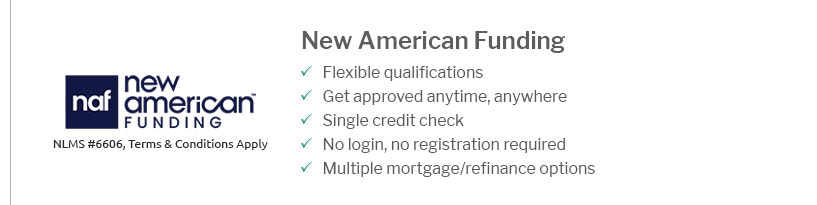

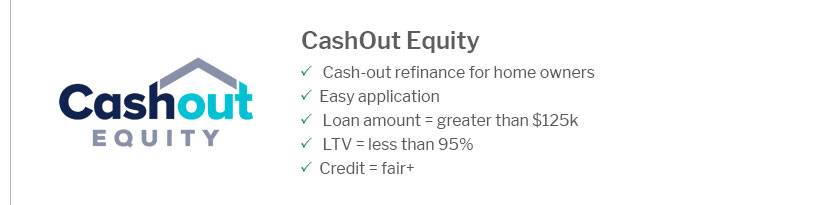

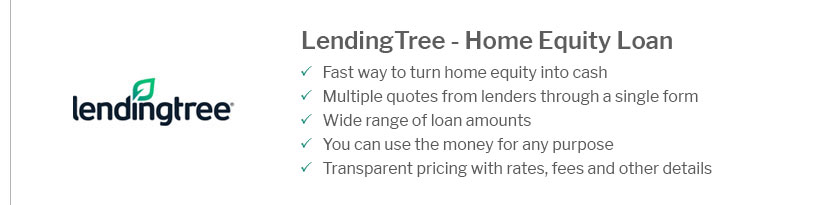

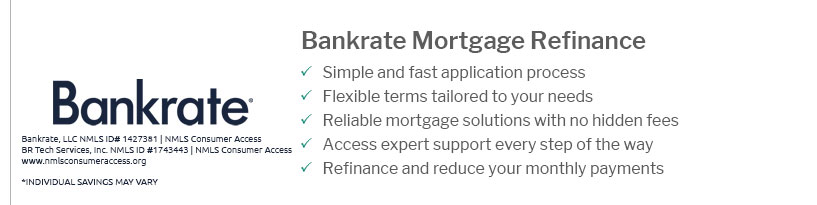

illinois refinance rates today: how to compare options and lock a smart dealWhat drives Illinois refi pricingBorrowers scanning today’s quotes will see that lenders in Illinois price loans based on credit score, equity, loan size, and whether you pursue rate-and-term or cash-out. Shorter terms usually post lower rates but higher payments, while discount points can buy down costs if you plan to stay put. Popular choices comparedThree common paths tend to surface for homeowners weighing a refinance. Each shines in a different scenario, and the best fit depends on payment goals and time horizon.

Tips: gather two or three lender quotes on the same day, compare APR and total five-year cost, and ask about lender credits versus points. Finally, verify break-even months so the savings exceed closing costs before you lock. Some related topics:

|

|---|